Manually extracting data from complex documents at scale can be a time consuming process which is why Google Cloud has announced its new Document AI (DocAI) platform.

The unified console for document processing enables businesses to use the power of AI and machine learning to automate the process of transforming documents into structured data.

With the DocAI platform, which is currently available in preview, organizations can ensure their data is accurate and compliant, make better business decisions and use their data to better meet customer expectations.

In a blog post announcing DocAI, Google revealed that one of its customers was able to increase data capture accuracy by 250 percent and lower the TCO of procure-to-pay processing costs by up to 60 percent using the new platform.

Using DocAI

With Google Cloud’s new DocAI platform, organizations can quickly access all parsers tools and solutions including Lending DocAI and Procurement DocAI with a unified API that allows for effortless creation and customization of document processing workflows.

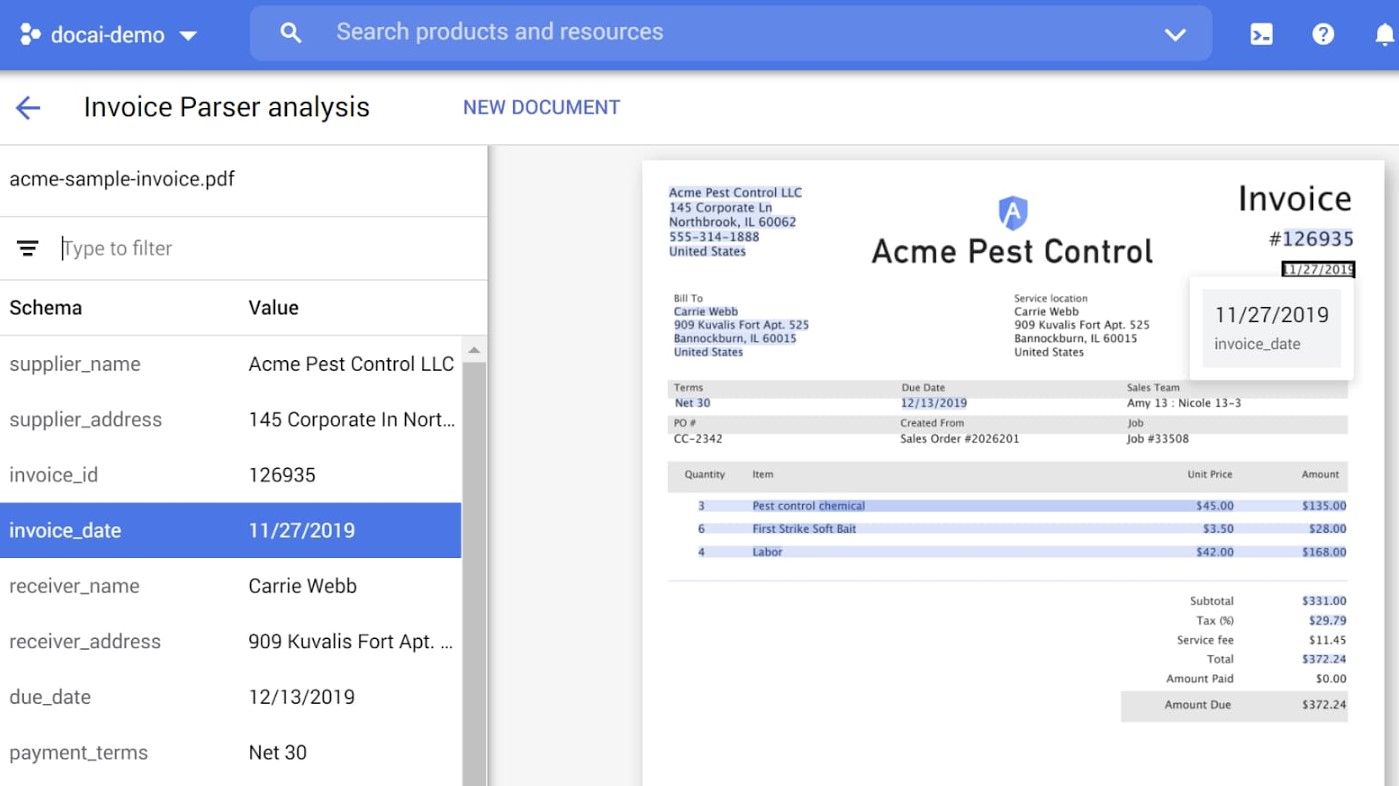

To get started using the new platform, users will first need to create a document processor. While you can use the company’s general processors such as Form Parser, you can also take advantage of specialized processors such as Google’s W9 Parser for domain-specific documents. After creating a processor, they can be viewed in a unified dashboard and tested by uploading your own document directly in the console.

In their blog post, product manager of Document AI Lewis Liu and product marketing manager Yang Liang provide several examples of how the platform can be used to extract data from a W9 form as well as from an invoice. When it came to the invoice, DocAI was able to extract the supplier name, invoice date, payment terms and other data from the document automatically.

Currently general parsers such as OCR (Optical Character Recognition), Form parser and Document splitter are publicly available but users can also request access to specialized parsers for a number of documents including W9, 1040, W2, 1099-MISC, 1003 and other forms as well as for invoices and receipts.

Comments are closed.