Spot Money banking explained » Stuff

In recent years we’ve seen the South African banking industry experience major shifts toward more digital accessibility channels. New entries into the market like TymeBank, Bank Zero and Discovery Bank have pressured traditional banks to rethink financial services. Now, South Africa’s newest entry, Spot Money, functions as an open banking platform — something we haven’t seen in the country yet.

Spot Money evolved from Virgin Money Spot, into just Spot after it acquired a local equity firm. It’s not a bank in itself, and calls itself ‘bank neutral’, meaning it’s not aligned to one particular financial institution. Spot has the ability to freely partner with any financial service provider without any allegiance — that’s the secret of Spot.

Spot the difference

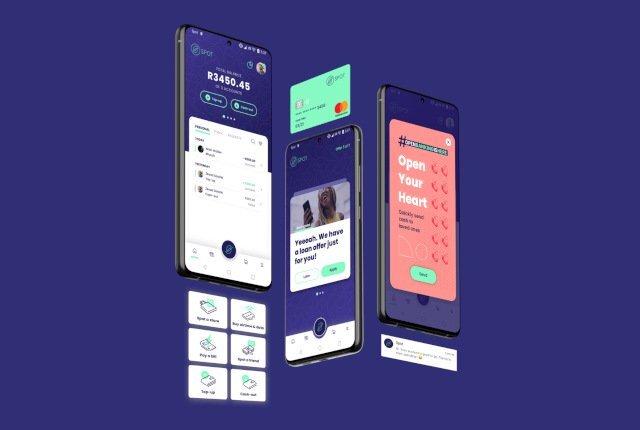

Along with the rebrand, Spot launched a brand new app that is powered by MasterCard’s tech — which means it can issue virtual and physical debit cards to any user that signs up to the platform. Right now, it’s free to sign up, and a physical debit card will be issued and delivered to users at no charge.

Along with the rebrand, Spot launched a brand new app that is powered by MasterCard’s tech — which means it can issue virtual and physical debit cards to any user that signs up to the platform. Right now, it’s free to sign up, and a physical debit card will be issued and delivered to users at no charge.

The point is that, being neutral, Spot can offer its users any financial product, whether it’s a loan, insurance policy or an investment opportunity through its platform. At the same time, it’s able to offer users lifestyle services, like rewards programmes and digital services.

Users also don’t need to drop their current bank for Spot, and can easily link their current bank cards in the app, allowing Spot’s service suggestions more insight into your financial standing. Of course, you don’t need to link your existing accounts with Spot if you don’t want to — it’s completely optional.

How Spot Money works

Using either their Spot account or their *insert other bank here* account (provided it’s linked to Spot), users can make online payments in a variety of ways. Spot prides itself in being a ‘banking and payment’ platform, with a specific focus on payments.

Through the app, users can pay at any quick response (QR) code terminal or pay point, with a tap-to-pay option and, of course, the nifty virtual card that can be used for online transactions.

It’s an interesting offering, and we’re keen to see how South Africans react to this open banking platform. A general concern when it comes to financial products and apps is security and viability of services. Being backed by Mastercard’s tokenisation tech definitely gives Spot a bonus point.

Comments are closed.